|

Background

Investors tend to conflate their anxiety about politics with anxiety about the market. With less than a week until Election Day in the U.S., we want to share some high-level observations about possible election scenarios and some market perspectives for investors. We are doing this now rather than waiting for the election results because we want advisors to be able to prepare investors in advance of the election for whatever outcome might trigger their investing fears.

Potential Election Outcomes

Because of the number of House of Representatives seats currently held by Democrats that Republicans would need to win, we don’t see a Republican “sweep” where they have won the White House, the House of Representatives, and the Senate. In contrast, Democrats would only need to win four seats to gain control of the Senate, which early polling shows to be a real possibility. As a result, we believe the five most likely election scenarios, roughly in order of likelihood at this time, are the following:

- A Democratic “sweep” in which Democrats win the White House and a majority in the Senate while retaining a majority in the House

- Trump is re-elected and Republicans retain a majority in the Senate while Democrats retain a majority in the House

- The Presidential election is contested in the courts, Republican retain the Senate, Democrats retain the House

- Biden is elected President while Republicans retain a majority in the Senate and Democrats retain the House

- Trump is re-elected President while Democrats win a majority in the Senate and Democrats retain the House

We believe scenarios 1 and 2 are the most likely election outcomes. US voters are so polarized, with each side vilifying the other, that it seems unlikely they would split their votes for President and Senate between a Democrat and a Republican.

Election Outcomes vs. Market Outcomes

Although investors are inclined to believe that election outcomes will dictate what happens in the markets and their portfolios (and this may, in fact, be true in the very short-term), the reality for investors is that the future of the market is less sensitive to elections than it is to today’s fundamental drivers of stock prices including:

- Monetary stimulus

- Fiscal stimulus; the passage of a coronavirus relief/fiscal stimulus package

- Resolution of the unknowns stemming from the upcoming elections

- Progress toward a vaccine

- The strength and breadth of market price momentum (investor sentiment)

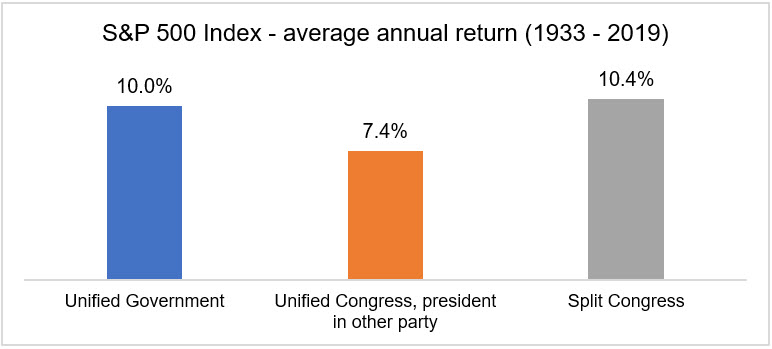

Source: Capital Group, Election uncertainty looks increasingly certain. Unified government indicates White House, House of Representatives and Senate are controlled by the same political party. Unified Congress indicates House and Senate are controlled by the same party, but the White House is controlled by different party. Split Congress indicates House and Senate are controlled by different parties regardless of White House control.

The good news for investors is that, regardless of who wins the election, all of these fundamental market drivers generally support stock prices in the intermediate term (one to four years). The Fed seems likely to keep interest rates low until the economy is back at full employment (probably sometime after 2023). Although the Democrats and Republicans have different visions of coronavirus relief/fiscal stimulus with very different elements and different sizes, both parties recognize the need for incremental assistance for unemployed workers and struggling businesses to keep the pandemic-induced recession from feeding on itself. Congress will likely provide additional stimulus once the political pressure of the election is past. As we frequently comment, markets hate uncertainty and, ironically, the election itself has been a major source of uncertainty weighing on stock prices, but stock prices usually rise once the uncertainty of the election is settled. Even though the spread of the virus seems to be accelerating in the United States, and Europe seems to be in the midst of a second wave of infections, progress toward a vaccine continues to hold out hope that one day our work lives and social lives will eventually return to something closer to ‘normal.’ Finally, the stock market’s rally, which year-to-date has been concentrated in a handful of very large, tech-related growth names, seems to be broadening over the past few weeks with a number of advancing stocks and a rotation of leadership into smaller capitalization and value names.

Impact of Corporate Taxes on Corporate Earnings

While the election is too early to call, based on the most-recent polling in battleground states, the most likely election outcome is a Democratic sweep with Biden winning the White House and Democrats picking up an additional three to five seats in the Senate.1 Investors who are supporters of President Trump, or just wary of tax increases, may worry about the impact of Biden’s tax proposal, if enacted, on the stock market. Biden has proposed a corporate tax increase that raises the nominal corporate tax rate from 21% to 28%. Worried investors should be reminded that nominal corporate rates would still be well below the 35% rate in place before the Tax Cut and Jobs Act passed in 2017. In addition, the increase in the nominal corporate tax rate is higher than the expected increase in the effective tax rate that companies actually pay after taking advantage of all the deductions, exemptions, and credits available to them. J.P. Morgan estimates that the effective tax rate under the Biden proposal is likely to be only 3.5 percentage points higher than in 2019.2 This could be more than offset with the fiscal stimulus included in Biden’s spending proposals around clean energy, healthcare, education, and a higher minimum wage. While the corporate tax increase will certainly reduce after-tax profits on a standalone basis, it is important for anxious investors to keep in mind that the tax increase is only one part of Biden’s overall fiscal plan which has plenty of stimulus spending (funded in part by the tax increase) and job creation that should help to increase corporate profits and stock prices.

Biden’s tax proposal also includes a capital-gains tax for households earning more than $1 million annually. For these high-income households, capital gains would be taxed at the same rate as ordinary income. Theoretically a higher capital-gains tax would reduce the incentive for high-income households to save and invest, leading them to instead spend the money on additional consumption. This higher capital-gains tax may weigh on stock prices (especially in the very short term, when the proposed tax legislation begins to be debated), but longer term, additional consumption by wealthy households would be good for overall economic growth, potentially offsetting the tax hike’s downward pressure on stock prices. As Kezia Samuel discussed in her "On the Mark" commentary last week, the history of the full range of tax increases (personal, corporate, and capital gains) is often followed by positive returns for stocks, depending on how the incremental tax revenues are re-invested in the economy.

It is worth pointing out to concerned investors that Wall Street firms have almost certainly already factored the possibility of Biden’s tax and spending proposals into their forecasts and seem to be positively inclined toward them. Goldman Sachs’ Chief Economist, Jan Hatzius, wrote about the prospect of a Democratic sweep saying that “all else equal, such a ‘blue wave’ would likely prompt us to upgrade our forecasts.” Goldman Sachs’ view is that the proposed spending in Biden’s plans “would at least match the likely longer-term tax increases on corporations and upper income earnings…It would result in a substantially easier US fiscal policy, a reduced risk of renewed trade escalation, and a firmer global growth outlook.” Goldman isn’t the only Wall Street player to highlight the potential benefits of a Democratic sweep. Moody’s Analytics concluded that Biden’s proposals, if passed as legislation, would return the U.S. economy to full employment in the second half of 2022, almost two years earlier than under Trump’s plan.3

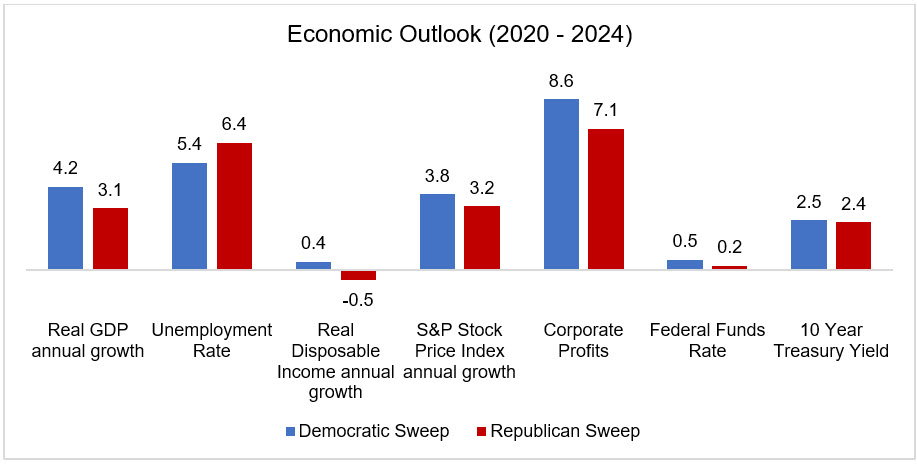

Source: Moody’s Analytics – The Macroeconomic Consequences: Trump vs. Biden, 23 September 2020.

Impact of Trade Tariffs on Corporate Earnings

A Democratic sweep is by no means certain and if Trump’s or the Republicans’ election chances strengthen as we approach Election Day, the subset of your clients who are worrying will be different—but equally—stressed. Passionate progressives and “Never Trump” Republicans may begin to worry that a second Presidential term for Trump might keep the U.S. mired in the current economic recession or potentially worsen it with new trade tariffs (that effectively function like corporate taxes on the US firms that pay them) and risk of business interruptions stemming from possible protests related to social unrest. Although neither Trump nor the GOP platform spell out exactly what policies to expect from a second term of President Trump, the market assumes a continuation of initiatives from his first term, including higher trade tariffs, making permanent elements of the 2017 tax cut that are otherwise set to expire after 2025, and to extend the immediate expensing of capital outlays at a 100% rate which is currently set to gradually decline each year until it expires after 2026. According to Moody’s Analytics, Trump has proposed a $1 trillion infrastructure spending package over a decade (relating to surface transportation programs, broadband and water). Offsetting this spending and the revenues lost in connection with his tax plan, Trump has also proposed healthcare spending be cut back along with spending on the Supplemental Nutrition Assistance Program and reducing the expense of health and retirement benefits for federal government employees. Because we don’t think Republicans’ winning a majority in the House of Representative is realistic this year (although a lot can change between now and mid-term elections), we think Republicans would need to compromise quite a bit to get the House to support further tax cuts and reductions in spending on the social safety-net. Despite the low probability of a Republican sweep, Moody’s Analytics compared the growth rates it would expect to see in the market and the economy in the event of a Democratic sweep and a Republican sweeps an exercise to “book end” the potential outcomes of the various policy proposals that have been floated by the candidates and their parties.4 While the outcomes look better for a Democratic sweep, it is worth highlighting for worried investors that improvement is expected in both scenarios as well as divided government scenarios that were also considered.

Market impact of a Contested Election

Fueled by President Trump’s claim that mail-in voting would result in a “rigged election”, some investors feared the potential for a contested election that could drag on for weeks after Election Day, until court challenges to state vote counts were decided. If the vote count is close in key swing states, we may yet see court battles. Fitch Ratings, a global provider of credit ratings, research and commentary for global capital markets felt compelled recently to warn that a contested election, to the extent it is viewed as undermining the rules and transparency of the election process and undermines the smooth transition of power, could lead Fitch to drop its AAA credit rating for the United States.5 Such a scenario could result in market turmoil and greater expense for the US government and corporations to maintain their record levels of debt.6 While we acknowledge the possibility of a contested election, we currently feel the likelihood of this scenario is significantly less than had once been feared because voter concerns about mailing their ballots and the availability of early voting several weeks before Election Day in most of the battleground states have fueled heavy early-voter turnout at polls, increasing the likelihood that election results are known relatively soon after the polls close.

Positioning Your Portfolio if You Think the “Other Side” Will Win

A presidential election is a great example of an instance where investors think they know something that has not already priced into the market. These investors should be reminded that even if not already fully factored into the market, it has at least been priced in on a probability-weighted basis. In addition, regardless of their political leanings, we should remind investors that the stock market seems positioned—over the intermediate and long term—to resume growing regardless of the election results. The growth may be slightly greater in the event of a Democratic sweep but is likely to be positive in all election scenarios other than a contested election.7 That’s the good news. The sobering news is that the market has already recovered from its plunge earlier in the year, so further market appreciation is likely to be moderated in any of the likely election outcomes. After almost a decade of a strengthening US dollar, international markets may finally be positioned to enjoy a tailwind if the US dollar’s weakness extends beyond 2020. We will almost certainly see different opportunities in the market depending on the election outcome, but these differences are likely to be within the stock or bond markets, rather than at the macro asset-allocation level. For example, if it takes the U.S. longer to get the growth in coronavirus cases under control, the outperformance of large-cap growth companies may be extended; or, if after the election investors think we are more likely to get the virus under control and to see significant fiscal stimulus, we may see an internal rotation within the stock market toward lower quality, smaller capitalization, and value stocks.8 Another important difference is that in the event of a Democratic sweep, municipalities are more likely to receive federal assistance, which may support the pricing of muni bonds broadly. Similarly, healthcare, construction, and clean energy are more likely to benefit from Democratic proposals, while financials, pharma, tech and energy may be more likely to benefit from Republican policies.9 In any event, the micro-positioning among sectors are better left to active fund managers and strategists, and not combined with the high-level asset allocation decisions investors need to make with their advisors. While the policies that result from the election may create new leaders and laggards among stock sectors, these trends will play out over time and not require advisors or investors to anticipate them or to immediately rotate sector/style exposures in their portfolios.

Concluding Thoughts

On November 3rd, Americans will vote. They may elect a new president (or not) and may change control of the Senate (or not). While we can’t tell you the outcome of the election, we can advise investors on how to position their portfolio heading into it. The reason for this is that while the timing, magnitude, and details of what happens in the markets may depend on the election, market direction and relative performance will be largely determined by other, more basic, factors. These factors all seem to be positive for the stock market, regardless of the election result. Investors risk incurring an opportunity cost that may be difficult to overcome if they confuse politics and investing. The key reality for investors is that both parties want the economy to recover and keep growing. The policies of the two parties may be markedly different, but the key drivers of the market will be monetary stimulus, fiscal stimulus, progress toward a vaccine to address the current pandemic, and the possible reversal of the long-term appreciation of the US dollar.

To be clear, we do not mean to suggest that this election does not matter. On the contrary, the consequences of this election may be as—or more—important than any US presidential election in living memory, just not for whether investors should maintain or change the asset allocation of their portfolios.

|