|

Executive Summary

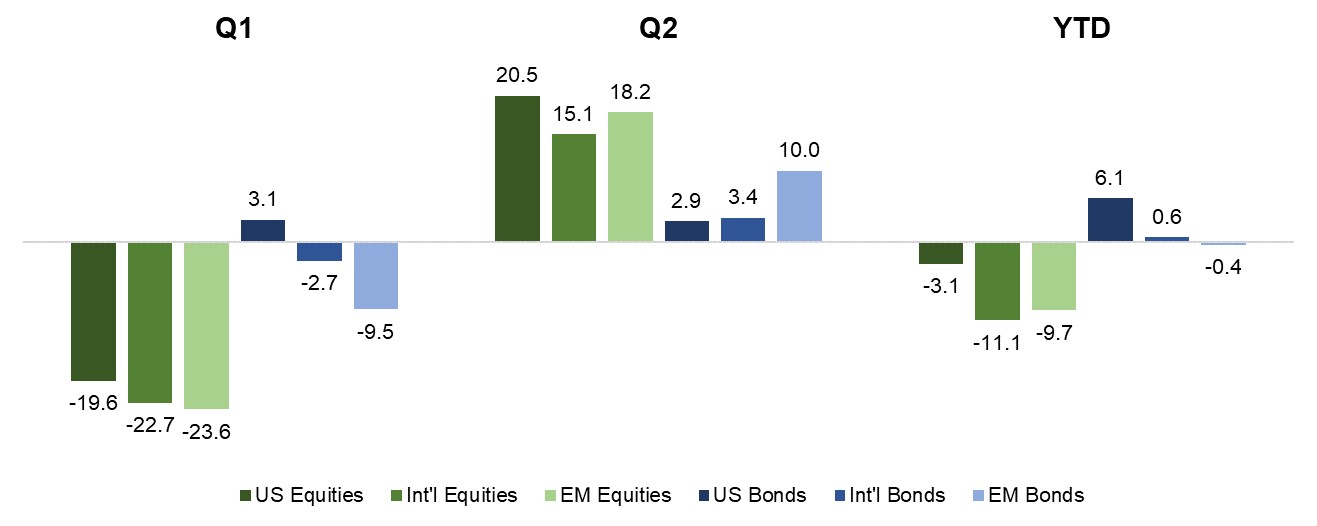

- US stocks had a strong second quarter, returning 20.5%1 as they rebounded from their sharp drop in the first quarter. Other risk assets also rebounded strongly in the second quarter but not enough to get out of negative return territory year-to-date.

- Actual portfolio performance experienced by many, for the second quarter and year-to-date periods, will probably disappoint investors as diversified portfolio performance once again exhibited lower returns relative to those of widely reported US stock indexes. The pronounced underperformance of value stocks (i.e. stocks that are cheap relative to some measure of intrinsic value) and relatively narrow market leadership explains much of this difference.

- Income-oriented investors are likely to be most disappointed given that the worst performing sectors of the market year-to-date (Energy and Financials) are usually over-weighted in income portfolios relative to broad market equity indexes due to their higher dividend yields and/or coupons.

- The glaring disconnect between the rising stock market and alarming economic and public health headlines may make individual investors anxious that the market is about to fall, possibly testing a new low for the year. While the market may indeed fall again before recovering, we think it unlikely to test a new low for the year.

- The unusual combination of unknowns this year: election results in the U.S., the willingness of the political parties in Congress to agree on a compromise relief bill to sustain US consumer demand, the path of the Coronavirus, and progress toward a vaccine leave investors with few prudent alternatives to broad diversification across asset classes, regions, sectors and styles (even though such a strategy has recently underperformed standalone popular US equity indices). Investors with greater risk tolerance may want to tilt portfolios to the eventuality of an economic recovery that would likely favor stocks in cyclical sectors, but the more common goal of retirement investing is to limit the worst-case scenario rather than “swinging for the bleachers”.

A Sharp Rebound in the Stock and Credit Markets

Source: Morningstar

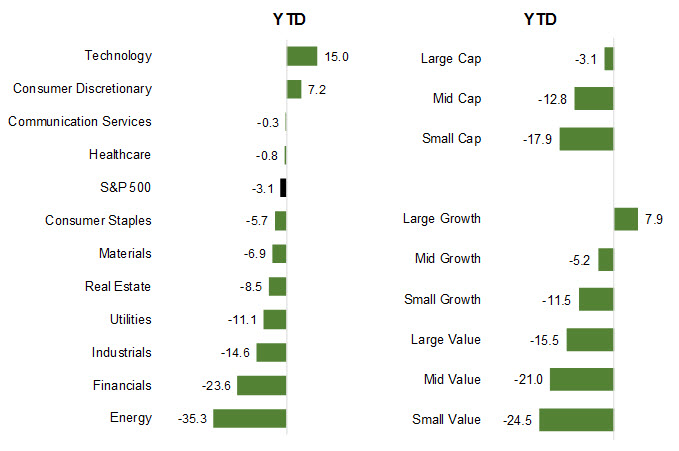

Equity markets enjoyed a strong quarter returning 20.5% for US stocks and 19.4% for global stocks.2 But the strong quarter was off a low point the market found after an even larger drop in stock prices in the first quarter. Consequently, despite the feeling of a huge runup from the markets’ low point, US and global stocks still had returns year-to-date of -3.1% and -6.0%, respectively.3 Other risk assets also enjoyed a substantial rebound in the second quarter with high yield bonds returning 10.2% and US REITs returning 13.3%.4 In none of these cases was the rebound large enough to get risk asset prices back to where they began the year. Stock price increases were spread more broadly in the second quarter than the first with mid-cap and small-cap stocks enjoying higher returns than large-cap stocks. Similarly, the second quarter saw strong returns across every sector of the market, but with the exception of Technology and Consumer Discretionary (which is dominated by Amazon), all sectors still had negative year-to-date returns.

Investor Perceptions of Performance

Source: Morningstar

When investors check in on their equity portfolios, they might be disappointed to see year-to-date performance below that reported for the S&P 500. The reasons for this are two separate-but-related phenomena. The first is the narrow leadership of what has driven the US stock market’s performance. Year-to-date, six large-cap growth companies (Facebook, Amazon, Netflix, Microsoft, Apple, and Alphabet (Google) have contributed 5.4% to the return of the S&P 500, while the other 495 stocks contributed a more-than-offsetting return of -8.64. The second phenomenon is the underperformance of value stocks (stocks that appear cheap relative to some measure of intrinsic value) which are a common value-added tilt used by managers. Value stocks underperformed the broad blended index in the second quarter by almost 14 percentage points.5 While growth and value stocks have historically cycled back and forth in terms of performance, the current period of underperformance by value stocks has now persisted for more than a decade, making investors impatient.

Income-oriented investors who elected to maximize their income by emphasizing high-dividend stocks and high-yield bonds are likely to be particularly disappointed in the year-to-date returns for their portfolios. The Dow Jones U.S. Select High Dividend Index had a return year-to-date of -21.7% while the S&P 500 returned -3.1% for the same period. The explanation for the difference is that Energy and Financial sector stocks – the two worst-performing sectors of the market year-to-date – represent a larger percentage of high-dividend portfolios and indexes than they do in broad market equity portfolios and indexes. Energy economics were badly hurt in the first quarter and stocks in the sector returned -50.5% when the price of oil temporarily collapsed in connection with a Saudi-Russia price war at the same time the pandemic starved demand.6 Separately, the Financial sector returned -31.9% in the first quarter.7 The Fed’s bond buying program to flood the markets with liquidity has “flattened” the yield curve and deprived banks of interest-rate spread income. In addition, the Fed recently sought to bolster the capital adequacy of banks by prohibiting them from increasing their dividends or repurchasing their own shares, which—at least temporarily—narrows the range of opportunities for banks to drive up their EPS. Like high-dividend stocks, high-yield bonds performed poorly in the first quarter because they skew to Energy sector issuers whose credit tend to move in sync with their stock price.

The good news for income-oriented investors is that, as long as their energy stocks did not cut their dividends or default on their bonds, investors are receiving the income they expected and assessing the return on equity and credit risk obviously requires a longer horizon that 6 -12 months. As time goes by and we put the pandemic and recession behind us, prices of Energy and Financial sector stocks and bonds should recover. Another way for investors to think about this is that when they invest for growth and income the price appreciation is rarely delivered on the same steady schedule as the income.

Investor Anxiety

The typical investor’s anxiety about the market is probably high given that the steadily rising stock market seems completely disconnected from the headlines about record levels of unemployment and rising Coronavirus cases that have caused states to pause or reverse “reopening” plans. It would be understandable for the typical investor to think that a ‘day of reckoning’ is inevitable, potentially even testing the market’s low point earlier this year. While the market may very well pull back from its current level given all the different sources of uncertainty in investors’ outlook, we do not think current market pricing is irrational. Neither do we expect any pullback to approach the first quarter’s low point. We think this is unlikely for a few different reasons:

- Current stock market pricing always reflects investors’ forecasts of all future company earnings and not just the current year’s and the next.

- Although the stock market has rebounded sharply off its low point in Q1, it is still below where it began the year and well below its February high

- In fact, the overwhelming majority of stocks have had negative returns year-to-date consistent with investors’ uncertainty about the future. The rising level of the stock market has been driven by a handful of stocks whose businesses are insulated from, and in some cases enhanced, by the pandemic –Amazon is, perhaps, the best example of this.

- There are few alternatives to stocks for investors. Fixed income currently offers historically low yields with little or no likelihood of price appreciation.

- By providing unprecedented liquidity and cutting short-term interest rates close to zero, the Fed has created a safety net for large public companies and reduced the time value of money for investors. This increases the impact of income in later years on current stock valuations, allowing investors to ignore depressed earnings in the next 12 months.

- While there is still a lot we don’t know about the coronavirus, there are fewer unknowns now than there were at the market’s low point. We know that many companies were largely able to move employees to working remotely without a significant reduction in productivity. We know that the federal government introduced unprecedented fiscal stimulus to help support consumer demand. We know that wearing a mask, social distancing, and handwashing significantly reduces the risk of transmission. We know which industries have had their businesses disrupted less than others and we know more about the prospects for a vaccine. The less investors know about the risks of an investment, the more the price of that investment is depressed. Because investors know more than they did, the market should not revisit its earlier low.

What Might happen Next and What to do About it

For the next 12 to 18 months, investors should be prepared to see swings between big down days and big up days. As we have seen, price moves are driven by news about the coronavirus, election polling, the willingness of Congress to extend the CARES Act, and the latest unemployment and other economic data. From our perspective, the most prudent way for investors and their advisors to position portfolios, until a vaccine is broadly available and adopted, is to emphasize high-quality stocks and bonds in order to preserve capital to put to work during the recovery that will follow this recession. To be clear, we are not suggesting de-risking asset allocation because it is too difficult for any individual investor to time a market recovery. Rather, we are recommending investors add to the equity allocation in their portfolios stocks of companies that exhibit consistent profitability and attractive debt ratios. For the fixed income portion of the investor portfolios we are suggesting the addition of government bonds and investment-grade corporate bonds. This is admittedly not a portfolio designed to capitalize on a big upside opportunity, but rather to prudently avoid downside risk.

One way to think about what happens next in the market is to think through what the market is expecting or discounting and what might happen if the future does not conform to expectation. In our opinion, one “surprise” that could have the most negative impact would be if Democrats and/or Republicans see political advantage in sticking with their principled positions and don’t compromise to pass a new coronavirus relief bill. This would likely negatively impact domestic consumption and further damage the US economy. Because of its importance, the market seems to assume it will happen before the end of July when the CARES Act expires but the fact that the U.S. is nearing election season creates the risk that one or both parties may be unwilling to compromise. Another assumption baked into the market is that a vaccine will be available sometime in the first half of 2021. While this currently appears likely, a potential risk related to an effective vaccine being widely available is whether it is widely adopted. Given the suspicion in some parts of the U.S. in government mandates in general, and vaccinations specifically, a significant portion of the US population might refuse to be vaccinated, frustrating the country’s ability to achieve herd immunity. For example, a large percentage of Americans refuse to get vaccinated (one third of Americans were recently polled as being unlikely to get vaccinated unless the effectiveness of the vaccine were unusually high8) and we would be unable to have a large enough portion of the population with antibodies to achieve herd immunity.

We don’t believe that the results of the approaching US election have the risk of a major repricing of current market expectations. If Republicans retain control, the market is familiar with the status quo, so that should not be disruptive to the market. Current polls (which everyone now views with appropriate skepticism) suggest that the Democrats are likely to win the White House and potentially control of the Senate. Political leanings aside, Democratic control of the Executive and Legislative branches of government would probably be viewed by the market as mixed bag of likely policies, some favorable and some not. Democratic control will be associated with a higher corporate tax rate but also more powerful fiscal stimulus (e.g., infrastructure projects and/or direct supplemental payments to lower-income households with a higher propensity to spend), and freer global trade policies which would be viewed as good for the economy.

The possibility of a slightly higher corporate tax rates weighing on US company earnings combined with the fact that Europe and Asia appear likely to re-open their economies well before the United States means that investors should not give up on the potential for an allocation to international equities to add value despite an extended period of underperformance relative to US stocks. In the same way an international allocation may add value if the Democrats win control of the White House, a traditional recovery scenario would suggest an allocation to cyclical stocks that could benefit portfolios when we start to return to some of our “old normal” behaviors, but it also makes sense to keep exposure to the fast-growing new technology companies that will continue to profit from our “new normal” behaviors. As the recovery takes hold mid- and small-cap stocks that have underperformed large-cap up until this quarter should be well positioned to continue to catch up.

These different scenarios and considerations argue for broad diversification across regions, styles, and asset classes. In addition, we would point out that the market’s recent enthusiasm for growth/tech and shunning of value has resulted in some unsustainably high and low valuations for individual companies. As a result, another dimension of diversification that investors and their advisors should consider is adding, to the low cost, cap-weighted index ETFs, that have grown so popular over the past decade, actively managed strategies that can be tactical or individual stock portfolios that balance growth with reasonable valuation.

I hope you and your families are all safe and healthy during this challenging time.

|