|

Investor sentiment was shattered in the first quarter, and volatility rose as equities and bonds moved in the same downward direction. As the impact of the Omicron variant of Covid waned, other factors took hold of the markets – inflation rose to levels not seen in 40 years, war broke out in Ukraine, and the Federal Reserve raised rates, as did other Central Banks. With both equities and bonds in negative territory for the first quarter, and equities outperforming what usually is their natural diversifier, questions abound on what to do with portfolios.

Rising Rates and the Bond Bear

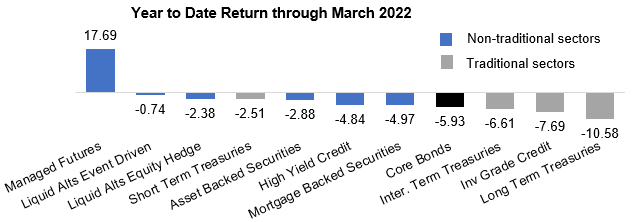

While there tends to be a lot of emotion driving equity markets, bond markets tend to be more about the math. Similar to the inverse relationship between rates and prices, the long-term return of a bond tends to be strongly correlated with its starting yield. In simple terms, a 5-year Treasury yielding 2.5% today will generally provide an annualized return of 2.5% over the next five years. In the long run, a higher yield is a good thing and can counter some of the price movement. But with price movement creating pain in portfolios today and inflation hurting real returns, using a more diversified approach with the inclusion of non-traditional benchmark sectors could help provide risk diversification.

Source: Zephyr StyleAdvisor

Not all bond sectors are created equal, and there are some opportunities, especially now that bond spreads have moved from their lows. Allocations to asset-backed securities and mortgage-backed securities give investors exposure to consumers’ balance sheets, while allocations to bank loans typically benefit from any rise in rates. The use of liquid alternatives1, like equity hedge strategies, event-driven strategies, or trend-following strategies (managed futures) could also prove fruitful during this time, given their lower correlation to equities and bonds.

Inflation is higher for longer

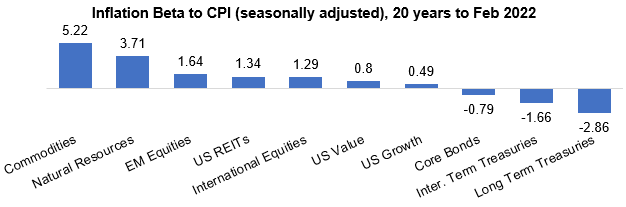

Inflation continues to stay stubbornly high. While transitory factors of energy, food, and vehicles eventually will dissipate, they will likely be replaced with the stickier factors of shelter costs and increasing wages. Shelter prices rose at the fastest pace (4.8%) since the early 1990s and make up the largest portion of the Consumer Price Index (CPI). So, it is likely inflation will be higher for longer. Asset classes with higher inflation beta – or sensitivity to movements in inflation – provide a level of diversification (see chart below). Equities can provide some protection for inflation, with the more cyclically sensitive value areas of the market having a higher beta. Commodities have the highest inflation beta, and while we probably all wish we had more commodities in our portfolios this year, the positioning needs to be balanced since commodities have high levels of volatility and can see prolonged periods of weak returns.

Source: Zephyr StyleAdvisor. The inflation beta shows how an asset class will move up or down per a 1% change in inflation.

Since the bottom of the market in 2020, a 5% position to commodities added almost 1% to return, and a 25% position added just over 4%. But with an increase of exposure to commodities comes the potential for a higher drawdown; for example, the portfolio with 25% exposure to commodities added 1% to the drawdown over the same period and trailed the portfolio with a 5% position to commodities in four of the past five calendar years. Commodities have risen sharply after being in the doldrums for many years – the last time the index doubled in two years was in the early 1980s. We also know a lot of the return tends to come in the initial rally, and just as quickly as they climb, they can fall. While having some exposure will likely be beneficial, given inflation will likely persist, we need to make sure positions are measured.

Higher inflation + rising rates = slower growth

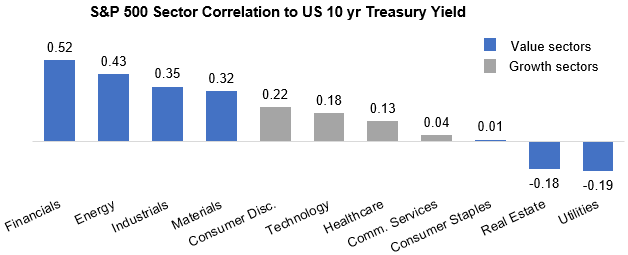

Growth will likely slow as the Federal Reserve seeks to take some heat out of the economy, but there is also likely sufficient pent-up demand to see growth reach the long-term trend growth rate by year-end. Equities can help provide returns during times of high inflation and rising rates, but it tends to be the value sectors that do better. Sectors like financials, energy, and industrials tend to do well during times of rising rates (see chart below), while defensive sectors like energy and consumer staples tend to do best when inflation is above 4%. Commodity- and natural resource-rich industries that can be found within value sectors are able to benefit from the higher commodity prices. Value also remains significantly undervalued relative to growth, which provides additional opportunities. But as rates rise and inflation starts to drop, the economy will likely start to sputter, and during these lower growth periods, the focus needs to be on higher-quality companies that tend to be found within the growth sectors.

Source: JPMorgan Asset Management, Guide to the Markets | US | 2Q 2022, as of March 31, 2022

International and Emerging Markets are another way to take advantage of the higher interest rate and inflation environment. International Markets tend to tilt more towards value sectors, while Emerging Markets benefit from commodities; for example, every country in Latin America saw positive returns year-to-date due to their linkage to natural resources. But with international investing comes higher risk and the need for patience and selectivity. Balancing investments in the US for growth and International for value could pay off in the long run as the economic cycles of these regions tend to move on differing paths.

Investment Opportunities from Market Volatility

We need to remember that market volatility is part of a functioning market. As the cycles shift and dominoes fall, portfolios will need to be braced for various outcomes. With recession risk increasing for 2023, recency bias leads us to fear the worst. But it’s unlikely to see the same level of decline in output as we saw during the Covid recession, and the recovery could be quick.

During times of volatility, there tends to be greater dispersion of returns across sectors, industries, and individual companies, which offers managers the opportunity to add value through active allocation decisions or security selection. This can complement broad market exposures to gain a little “more growth,” a little “more income,” or a little “more preservation.”

The key is to make sure the portfolio meets the goals and needs of the investor and not to try and time the shifts; rather, one should attempt to own the right exposures to take advantage of all changing market tides.

|