|

In some ways, the macroeconomic setup hasn’t changed all year. The Fed has finally recognized that inflation is not so transitory, and it has spent most of the year trying to catch up, with little measurable success so far. To summarize, the current policy framework: in the fight against inflation, the Fed is raising short-term interest rates, which will eventually slow growth, and subsequently slow inflation.

This process began in March with a +0.25% increase in the Federal Funds rate and was punctuated in June with a rare +0.75% increase, accompanied by a historically hawkish Fed statement. Predictably, equity and fixed income markets sold off sharply in response. In July’s unscripted press conference, Chairman Jerome Powell, in a moment of weakness perhaps, stated that the Federal Funds rate was already close to the neutral rate. The neutral rate is the level of short-term interest rates that neither stimulates nor restricts growth. Investors interpreted the statement as suggesting a shorter hiking cycle. Former US Treasury Secretary Larry Summers interpreted the statement as “indefensible” and “wishful thinking.” Predictably, the equity and fixed income markets rallied in response. Finally, in Powell’s highly scripted August Jackson Hole speech, he set the record straight with a short and hawkish speech. It concluded with, “We are taking forceful and rapid steps to moderate demand…and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.” Hawkish enough? Predictably, equity and fixed income markets sold off sharply in response.

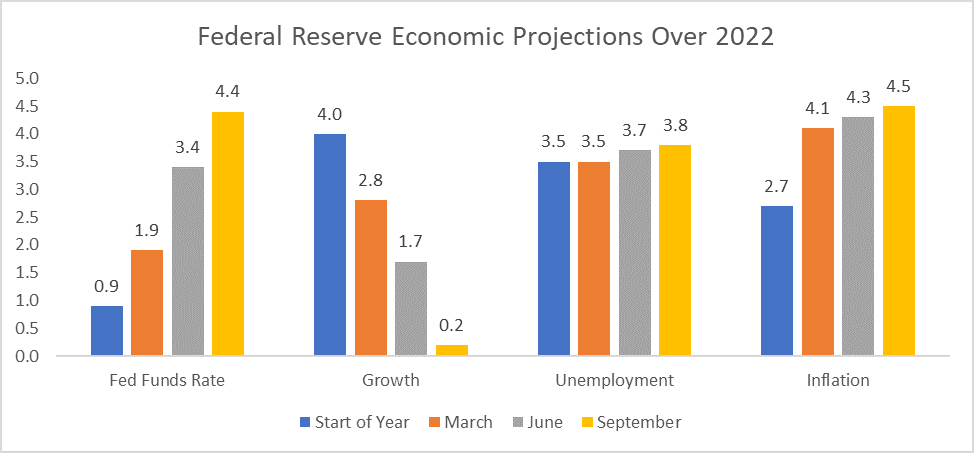

As the quarter progressed, it was clear that the Fed’s resolve would result in some economic pain. It was also clear that the Fed was more and more comfortable with that trade-off. At the beginning of the third quarter, the Fed expected they would raise the Fed Funds Rate to 3.4% by the end of 2022, resulting in 1.7% growth, 3.7% unemployment, and 4.3% inflation. By September, they expected they would raise rates to 4.4% (+1.0% higher rates), resulting 0.2% growth (-1.5% worse growth), 3.8% unemployment (+0.1% worse unemployment), and 4.5% inflation (+0.2% worse inflation). From the start of the quarter to the end of the quarter, the Fed expected higher rates, lower growth, and higher inflation (Chart 1). Clearly, they are willing to tolerate more economic weakness to achieve lower inflation. Predictably, equity and fixed income markets sold off sharply in response.

Chart 1 – The Fed’s 2022 Economic Projections as the year progressed

In the same way, the Fed dominated the second quarter market environment, and their shifting narrative also dominated the third quarter. When we zoom out, we observe that the Fed’s narrative changed during the quarter, but their economic challenge did not. We suspect that until inflation breaks meaningfully lower (with several readings that establish a path towards their long-term inflation target of 2.0%), the Fed’s hawkish challenge will continue to dominate the market environment.

Equity Market Outlook

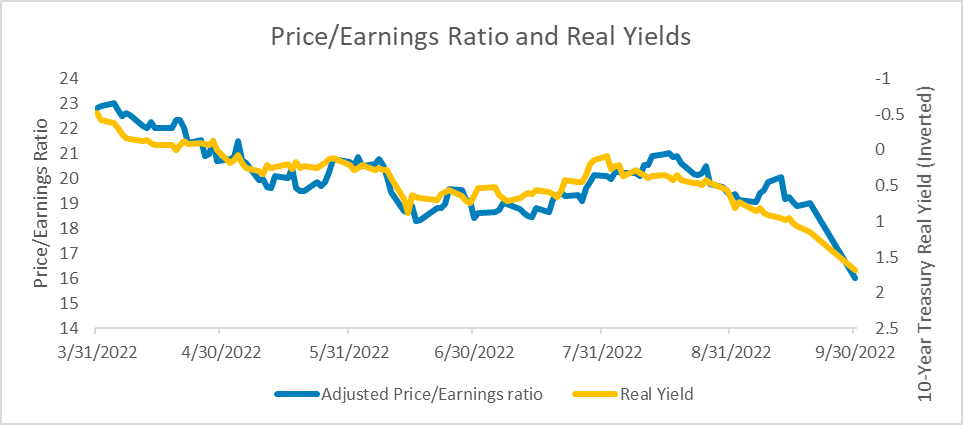

As we reviewed last quarter, higher interest rates impact equity prices by lowering growth (increased borrowing costs reduce the number of corporate growth initiatives), and by decreasing the present value of future earnings. In Chart 2, we illustrate the second concept - that as real yields have risen, investors are willing to pay less for a unit of futures earnings, resulting in a progressively lower price/earnings ratio.

Chart 2 – S&P 500 Price/Earnings Ratio and 10-Year Real Yields (Inverted)

This suggests that lower growth prospects have not yet been fully priced into market multiples. Given lower economic growth expectations, it seems likely that corporate earnings estimates will need to come down, continuing to pressure the equity markets over the near term. The good news is that analysts have already started reducing their estimates, so this process is already underway.

Bond Market Outlook

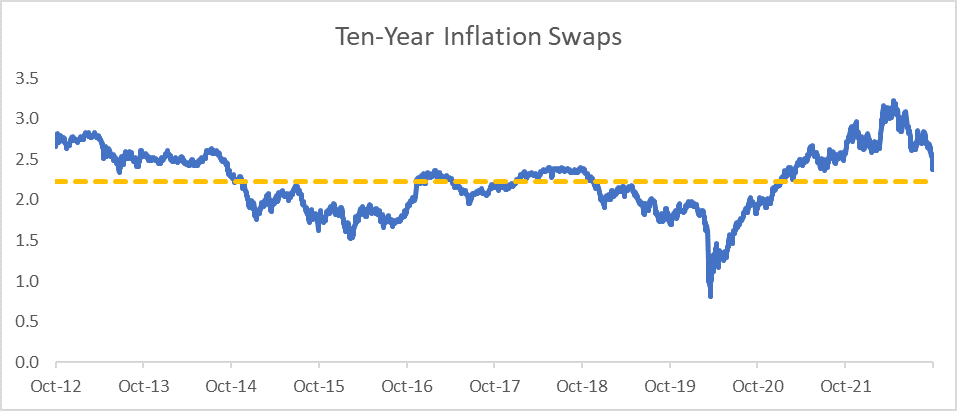

Much like equity prices, bond prices remained under pressure during the third quarter due to higher inflation and interest rates. The longer end of the yield curve is mostly driven by long-term growth expectations, long-term inflation expectations, and the neutral rate of interest (defined above). As long-term measures of growth and inflation have not changed that much (see Chart 3, for example), we expect longer-term yields to remain range-bond between 3.5% and 4.5%. Credit spreads have been widening all year and are likely to widen a bit further as economic growth is expected to continue to slow.

Chart 3 – Long-term Inflation Expectations

Putting It All Together

The year’s decline in bond prices has resulted in extremely painful losses for both bond investors and 60/40 (60% equity/40% bonds) investors alike. The silver lining, I suppose, is that with lower prices come higher yields. This provides a sounder base for constructing balanced portfolios. Not only do higher yields generate more income, but they also provide a price buffer against further yield increases, which should help in offsetting equity volatility.

It is difficult to tell if equities have bottomed. On the one hand, we have twice approached very negative sentiment from institutional investors and twice found “bottoms” around 3,600 on the S&P 500 (on June 16th and September 30th). On the other hand, if growth continues to slow, earnings estimates will likely need to decline a bit more from here. As noted above, that process has already begun.

For long-term investors, I would suggest that the “recession question” doesn’t really matter all that much. We know that recessions and bear markets happen – they are an inevitable feature of our economy and capital markets. We also know that equities have already declined -25% (from January 3 to September 30). History tells us that these declines often offer long-term investors outsized return opportunities. After a -25% decline in equity prices (since 1950), the average return over the next year is +20%, and the average return over the next three years is +32% (cumulative). Investors have already done the hard part. Now they need to be patient.

Ask a question about Christian's update

View Q3 Market Update

|